Discover more from Abe Murray | AlleyCorp / Deep Tech

AlleyCorp Robotics | December Newsletter

December 2023 | Here's to an exciting year in robotics!

A note from the author

Well folks,

This newsletter marks our last formal communication of 2023, and on a more personal note, the end of this month also marks the end of my first full year as a VC in the robotics space - And what a year it has been for the robotics ecosystem! From robotics transformer models, to significant steps forward for humanoids (pun intended), to witnessing tenacious CEOs navigate the challenges of the funding environment, I feel privileged to have been able to be a part of this community. Thank you to Kevin Ryan and Abe Murray in particular for bringing me on the AlleyCorp team 12 months ago.

This episode of our newsletter will cover our predictions about what to expect in 2024, our perspective on how the stage is set for unprecedented runaway adoption of robotics over the next decade, and as always, our favorite news artifacts from the past month.

Cheers,

BUT FIRST - A quick thanks from AlleyCorp’s General Partner, Robotics below.

You’re all awesome!

We’re grateful for all of you reading these. We’ve met so many phenomenal founders and investors - every one of you building things that matter in the world. We’re more optimistic than ever about living in a sci-fi future - you’re making it happen. Happy Holidays, Happy New Year, and here’s to an amazing 2024 ahead!

Four Predictions for Robots in 2024

1️⃣ The race to build a race of humanoids will intensify 🏁🦿: With Agility Robotics winning a pilot with Amazon Research Center and building a factory for scale production of Digit, they are leading the (rapidly growing) pack of humanoid robotics companies - we believe 2024 will be the first year we see these robots doing real work at meaningful scale, with continued strong progress from new entrants making for compelling demos and excitement throughout the year.

2️⃣ Deployed automation will mostly rely on trusty, old, well-understood AI ⌛🧠: While shiny new AI techniques for building foundation models are exciting and will eventually power production robots, companies deploying robots at scale with high reliability will continue to use more classic AI, motion planning, and control techniques in 2024. At the same time, we expect robotics startups to build on top of the recent development of AI infrastructure for robotics (like NYU’s Dobb-E, and Google's robotic transformer models RT-X). In 2024, more startups will enter the race to build proprietary data sets of robotic inputs & action outputs for specialized applications.

3️⃣ Robotics startups will land large customer contracts as labor shortages intensify 🔎🧑🏭: Labor is scarce and getting more expensive. The global workforce is aging and shrinking with labor costs rising everywhere. We expect this trend to continue in 2024, pushing companies to choose automation as hiring people becomes harder in the most labor constrained sectors (warehousing, manufacturing, agriculture, and hospitals).

4️⃣ Real revenues will be required 💸📈: Progress past pilot purgatory - robot and automation companies succeeding and winning in 2024 will earn production contracts and real revenue as they're forced to be capital efficient, earn their valuations, and restore runway through revenue.

Robotics News

Enjoy 15 of our favorite artifacts from the month of December (in no particular order)

Big Raises 🐘🤑

AI and ML for Robots 🤖 🧠

Robots Underwater 🌊🤖

Robots making robots 🤖 🏭

Robots Getting Stuff Done 🏗️🤖

Robotics Thesis - Why Robotics? Why Now?

This past month, we decided to dig into the data that underpins our robotics thesis to validate our empirically based market perspective. The outcome of the study was a 60-page thesis-style white paper that has made us even more bullish on the category. We’ll share the full document at a later point, but I’m excited to share an abridged version below to cover the highlights!

Purpose and Overview

We (the AlleyCorp Robotics team) expect that the global robotics sector will grow 10x in the next 7 to 10 years from ~$25B-$40B annually, to $300B or more by 2032. Our research and experience reinforce our belief that the U.S. market is poised to experience outsized growth relative to other markets due to the internal and external pressures that will speed customers along the adoption curve at a faster pace than any time in the last 20 years.

These underlying influences are described in the sections below, and broadly encompass demographic trends, economic incentives, and enabling technological breakthroughs. We also spend time to highlight the growing pains and headwinds we expect the sector to face on a macro level as it continues to develop. Finally, I analyze data across sources to review the performance of the robotics market over the past 10 years, and what it could mean for the next 10. Enjoy!

Demographic trends causing a labor shortage in the U.S.

The U.S. labor shortage at a glance

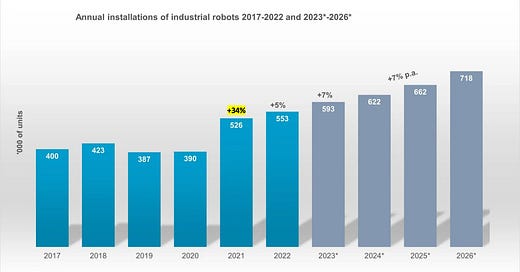

The U.S. demand for automation is higher than any time in the last 20 years due to long term labor shortages and demographic changes that have been brewing and are now taking hold. In total, the U.S. has 9 million unfilled jobs in the labor market, twice as many as two decades ago, and for the first time in recent history the number of job openings has surpassed the total number unoccupied Americans (and by nearly 50%). When looking at the top 10 industries bearing the brunt of the labor shortages, we’ve determined that robotics can be applied effectively to address the labor shortages in 7 out of the 10 most impacted sectors, shown as highlighted rows in the chart below.

Source: U.S. Bureau of Labor Statistics; Author’s analysis

Underlying causes of the shortage

The worker shortage across industries has been exacerbated by an aging workforce (as U.S. average life spans shorten, younger generations opt out of the workforce, and general fertility rates continue to drop) as well as by fluctuating immigration policy that has left an unanticipated shortage of 1.7 million migrant workers. To top it off, these slow-brewing factors were dramatically accelerated by the COVID-19 pandemic which restricted immigration, shocked the global supply chain, and caused workers to shuffle out of jobs requiring heavy manual work.

How robotics can help restore productivity

The U.S. in particular is uniquely facing a reduction in the labor force participation rate and the associated productivity decline is on track to leave 2033 GDP $10 trillion behind projections based on historical rates.

Fortunately, robotics have demonstrated an outsized and accretive impact on productivity across these industries because of the high portion of manual tasks they involve. To put it into numbers, The International Trade Association found that a 1% increase in robotics is associated with an average productivity increase of 0.8%, and as high as 5% in underpenetrated segments. By my calculations, if all segments with relevant applications for robotics were to increase robot density by 1% it could lead to $300B increase in GDP, and at 24% we can reclaim the $10T in lost GDP by 2033. Most of this growth will come from professional services robotics in new industries (which reminds me that if you haven't read F-Prime’s report on vertical robotics you should really check it out).

Economic motivations for robotic adoption

A confluence of economic trends, including the growing popularity of ecommerce, reshoring imperatives in the private industry, and government initiatives to improve U.S. manufacturing are directing investment into the sectors that stand the most to gain from robotic automation.

Ecommerce’s promise of 2-day (and today) shipping

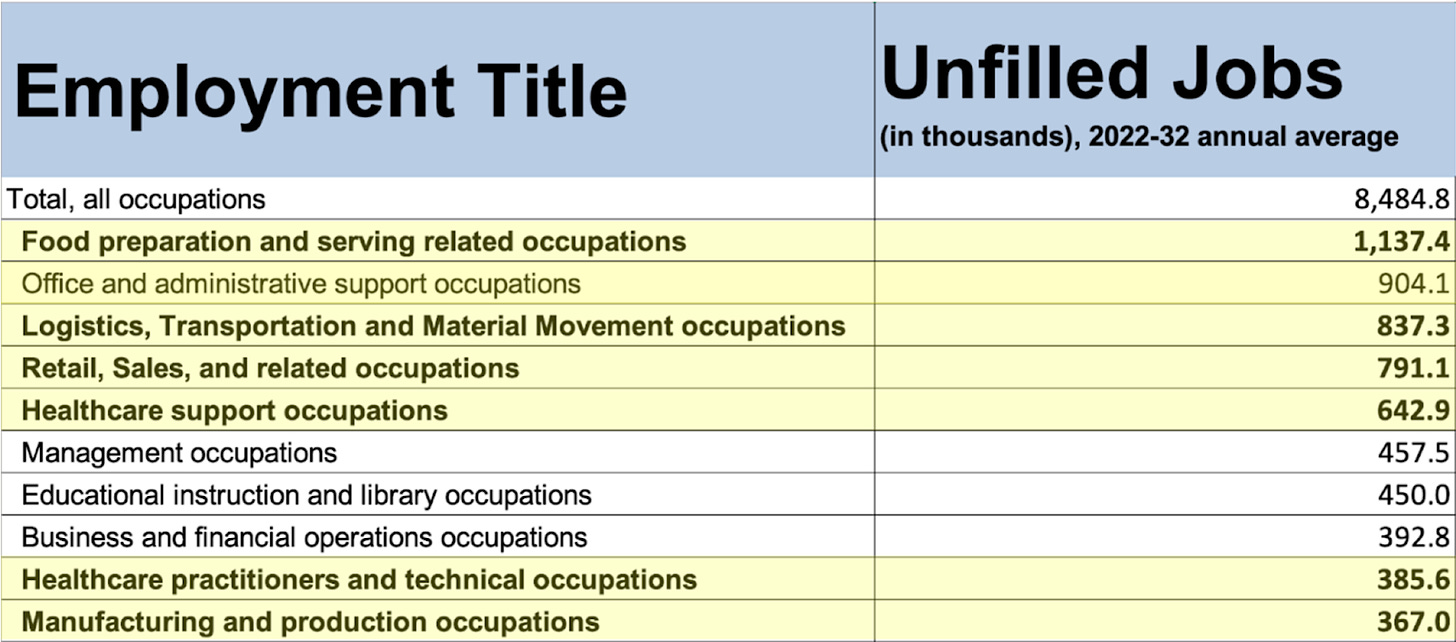

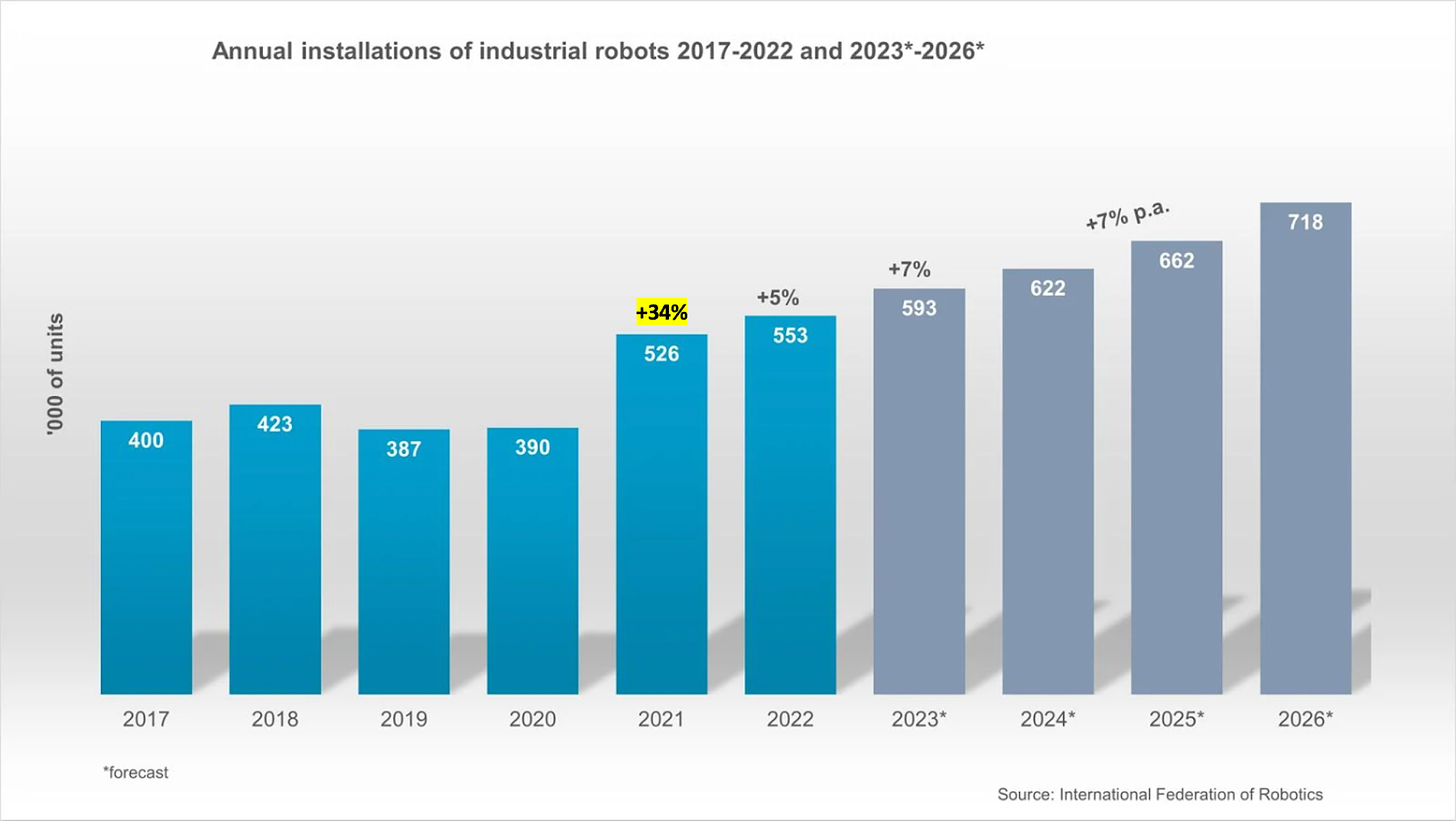

Ecommerce as a percentage of total retail sales jumped 4% between 2020 and 2021, nearly tripling the growth from the prior year. Since then, online spending has only been increasing, locking in the changing consumer preference (perhaps permanently). The need to fulfill end customer demand subsequently spurred a 34% YoY increase in the installations of industrial robots from 2020 to 2021, beating the prior record installations (set in 2018) by over 22%.

Reshoring - Made in America (or maybe Mexico or Canada)

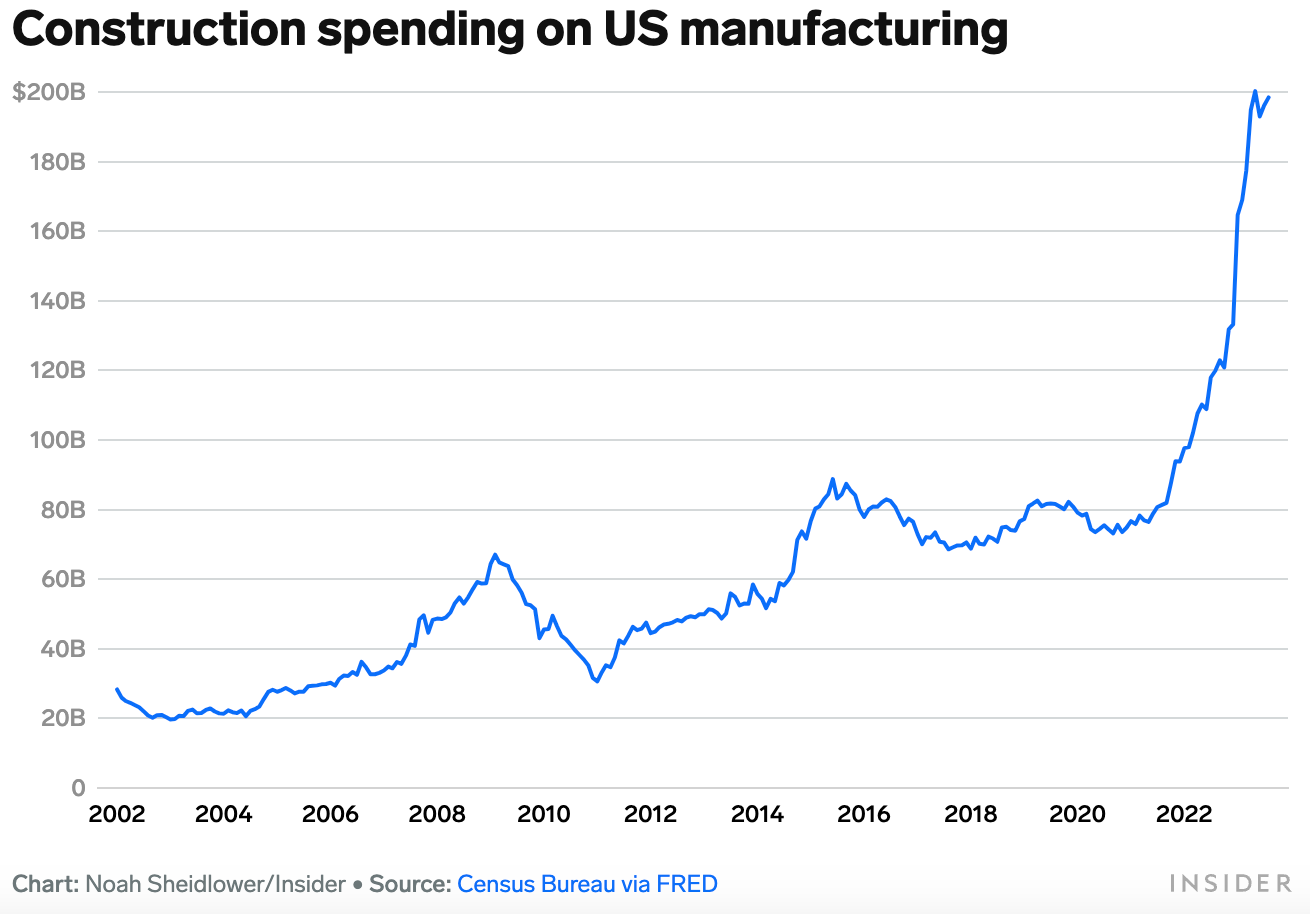

Reshoring and nearshoring are proving to be core strategic moves for companies looking to build resilience against the kind of supply chain shocks experienced during the pandemic. In 2023, more private investment was put into construction of factories on domestic soil than in foreign nations (59% to 41%), and re-shoring investment reached record highs of $200B this year.

As factories are returning, so are American jobs. 2 million positions have been announced which would bring back nearly 40% of the total jobs that have been outsourced overseas. As reshoring efforts mature and labor shortages intensify, automation will be required to keep the cost of production at new domestic factories competitive on the global market.

Government incentives including the Bipartisan Infrastructure Law (BIL), CHIPS and Science Act of 2022 (CHIPS), and the Inflation Reduction Act (IRA) will direct nearly $2T in total spending into revitalizing U.S. infrastructure over the next ten years. These reduce the overall cost of capital for U.S. industry players and will buttress investment into the sector despite a higher interest rate environment, and will continue to drive demand for labor in heavy industries (at nearly all stages of the value chain).

A new era in technological innovation

The technology underpinning autonomous and intelligent robotics has surpassed technical and functional thresholds in recent years making automation a viable choice across industries. Many of the improvements will enable robotics to take advantage of the latent opportunities in the U.S.

AI giving robots a (much needed) I.Q. boost

One of the most important factors in the recent technological improvements that robotics have made, are the dramatic strides in AI performance improvements over the last 5 years. Recent models (such as Google’s 2023 releases of PaLM-e, RT-2 and RT-X) are making progress in enabling robotics to deliver on the promises of AI - dynamically responding to their environments, understanding the context of their surroundings, reacting to new tasks and situations with intelligence, and even strategizing toward reaching an end goal.

Advanced semiconductor technologies

Compute technology provides the backbone for training large AI and ML models. It is a key requirement for processing and integrating complex and unstructured data from various sensor formats. Limitations of computational capability to perform these tasks have long been a top factor preventing robotics from developing enough generalized intelligence to create value outside of only highly structured, repeatable, and predictable environments (like just-in-time automotive manufacturing lines). Compute has increased power by 100X and decreased cost by 10X in the last 10 years unlocking the power and availability of AI on the edge.

5G cloud networks on the far edge

Innovations in 5G wireless connectivity enable separate local networks that sit between the edge and the cloud. As a technology, creating a network edge guarantees seamless transmission of data across a fleet of devices. It delivers these benefits through enhanced mobile broadband with speeds of up to 10 gigabytes per second, simultaneous connectivity of up to 1 million IoT connections per square kilometer, one millisecond latency for rapid response, and provides an option for private and purpose-built wireless networks on-premises, affording privacy critical applications to adopt.

Increasingly affordable hardware

Hardware costs for robotics have continued to decline due to the proliferation of subcomponent manufacturers, performance improvements that allow miniaturization, and a transference of complexity from the hardware to the software stack of a given robotic solution. EY reports that “The average price of an industrial robot has halved over the past decade, to about $23,000 in 2022 from $47,000 in 2011”, and other experts predict they can fall another 15%-60% over the next 5 years.

Growing pains for adolescent robots

The sector will not be without its headwinds and challenges as it matures. As we analyze the opportunities ahead for the sector, we find that each area will come with its own hurdles to be transcended.

Macro challenges for robots

Shifting demographic trends will bring challenges finding skilled labor that is capable of deploying, and overseeing more complex automation in factories. This remains a top objective for factory owners and will remain a challenge going forward. Implementing automation requires overcoming public misperceptions about the impact of robotics (from rampant job theft to full-on subjugation of human civilization) which is easier said than done. The current high-interest-rate environment and upfront capital intensity of innovation will introduce friction to the flow of capital investment. Even from a technological standpoint, robotics have a ways to go - there remain unsolved challenges in developing generalized AI for robotics, challenges with autonomy stack integration, and increasing instances of cyber attacks as data moves to the edge.

GTM Headwinds - the not-so-yellow brick road

For robotics at large, the road to success often includes a very unforgiving go-to-market motion and historically has made it challenging for robotics companies to reach large scale fast enough to avoid a premature erosion of market share (and profit margins) by competitors. In mature industries (like automotive, surgical applications, and traditional manufacturing), sales cycles for assets tend to be long because design iteration cycles are long and final products require extremely high reliability. In sectors newly looking to adopt robotics (like food, agriculture, and general healthcare), there is not much precedent at all, and the uncertainty around how to maximize ROI from automation delays swift uptake. As an added headwind, heightened regulatory restrictions on autonomous vehicles are being considered, in no small part thanks to recent and high visibility failures, increasing friction on the path to market.

A cause for hope

Acknowledging and investigating these headwinds is beneficial as a lens through which we focus for our forward looking predictions and strategy. We believe that the robotics companies that can best navigate around, or directly solve, these hurdles will experience an operational moat and an economic windfall.

By the Numbers

Looking back at the performance over the past decade

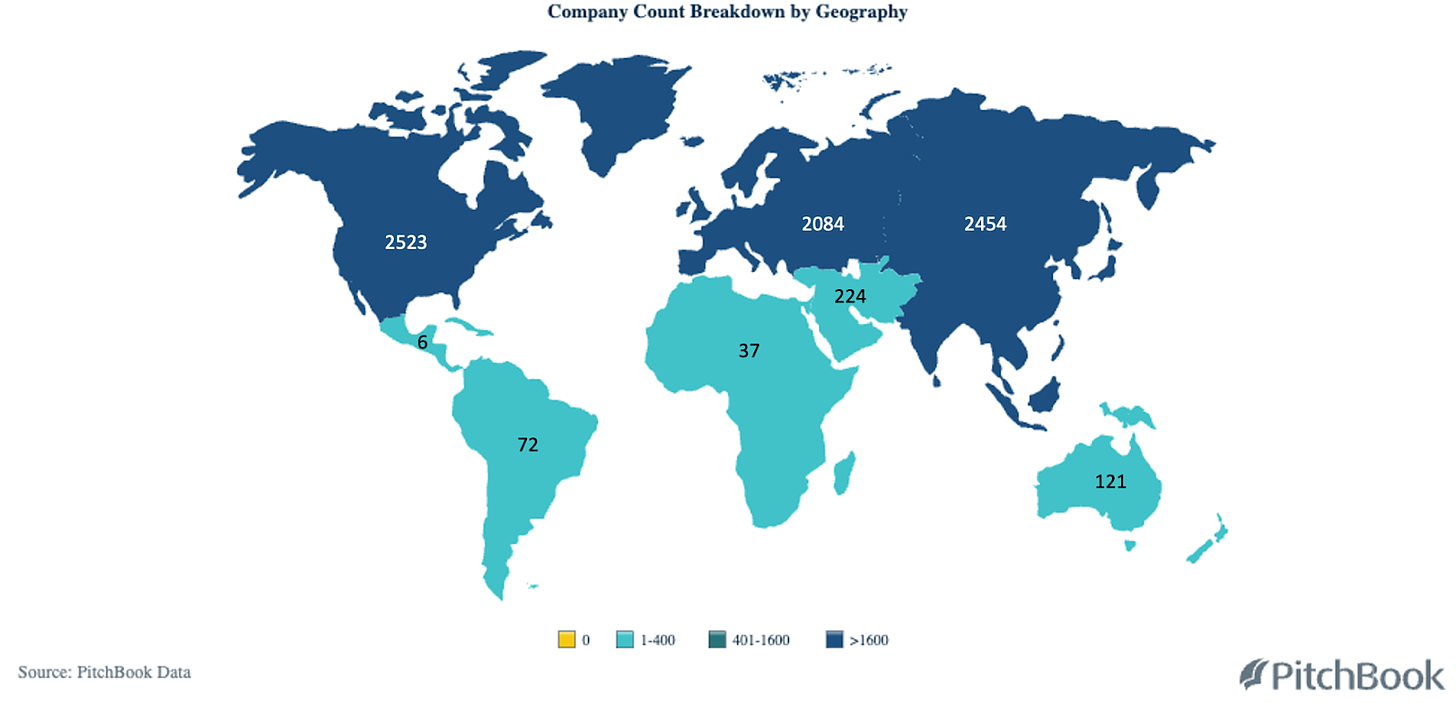

Finally, we review recent activity in the U.S Robotics market to validate the timing of our investment focus and deepen our conviction in the space. Although we do not exclusively invest in U.S. companies, the majority of our investments are here, and we find that on the global stage, the U.S. is the top contributor of robotics innovation throughout the last decade. It has supplied 2523 companies, whereas the entirety of Asia (excluding the middle east) has produced 2454 companies.

Narrowing our view to the U.S. market, we see that robotics companies have raised more capital than the generic startup market consistently over the last 10 years. They also demonstrate faster growth, and slower decline, (except for in the 2021 markets).

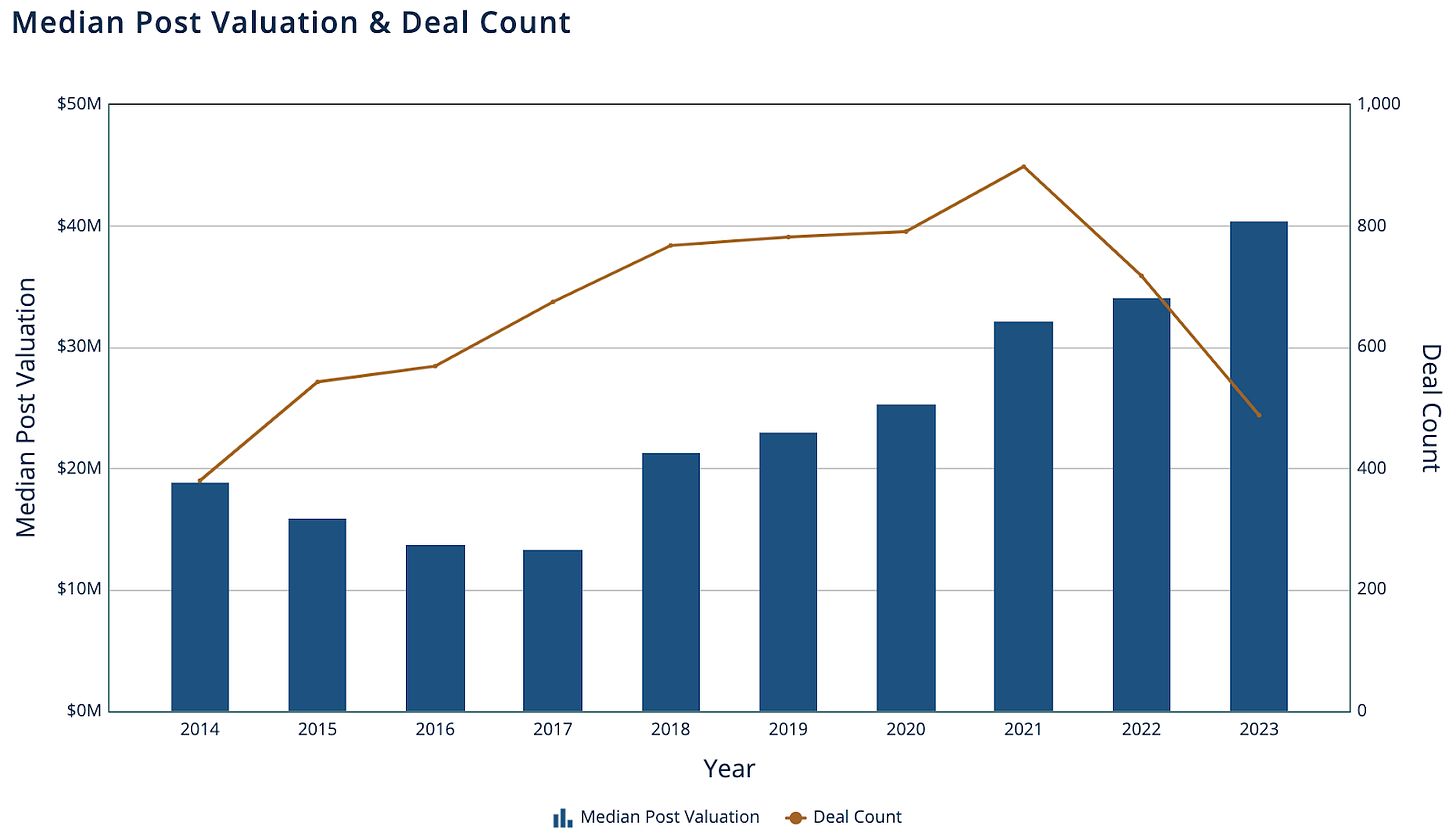

Restricting our focus further to analyze the recent performance of the robotics sector relative to its own historical trends, we find that in the last five years, total capital invested into the sector has tripled and the number of companies in the space has increased 1.5X relative to the prior five years. At the same time, average valuations of early stage robotics startups have continued to increase, even as the number of deals decreases in 2023. In fact, the most valuable early stage robotics companies have seen some of their highest valuations ever in recent years.

Source: Pitchbook Data Inc.

Despite the increase in valuations, 2023 saw a compression of the top end of the space, and the step up between the median robotics company and the highest raising company has declined to its lowest point since 2014, suggesting that the best early stage deals in this sector are relatively inexpensive, and possibly that the forecasted growth of the sector has not been priced in.

Looking ahead to the promise of the sector

The current generation of value generating robotics companies will be able to win without needing to raise as much capital as their predecessors. Following a similar trend to Web 2.0 versus Web 1.0 startups, the recent frothing private market made equity capital cheaply available for robotics companies, spurring massive growth in the sector. Going forward, CEOs will be required to be far more capital conscious and this paradigm will incentivize teams to make more progress per dollar of investor capital than any time in robotics history.

It is our firm conviction that the next decade will see robotics transition from “hard tech” (a somewhat ambiguous and misleading term) to just plain-old “tech” due to the accelerated ease of building in the category and the dramatically improved capabilities of the technology. We are transitioning to an era that will enable broadly productive robots on the path to full autonomy - the age of “ProBots”.

We are more excited than ever for the future of the robotics and smart hardware category. We believe that the external forces are primed for explosive growth and that the companies and founders who navigate the new environment well will experience runaway adoption of their solutions.

And that’s a wrap!

So that's what we have for you this time around! I hope you enjoyed it, and if you’ve made it this far, you may as well subscribe. Please feel free to reach out to me with any follow up thoughts, comments, or suggestions, and of course, we are always interested in meeting robotics and smart hardware founders. Thanks for reading and keep building!

Cheers,

Charts and other data from:

https://www.bcg.com/publications/2021/how-intelligence-and-mobility-will-shape-the-future-of-the-robotics-industry

https://www.bls.gov/news.release/jolts.nr0.htm

https://www.uschamber.com/workforce/data-deep-dive-the-workforce-of-the-future

https://www.mckinsey.com/mgi/our-research/rekindling-us-productivity-for-a-new-era

https://www.trade.gov/sites/default/files/2022-08/SelectUSAAutomationReport2020.pdf

https://www.statista.com/statistics/534123/e-commerce-share-of-retail-sales-worldwide/

https://ifr.org/news/world-robotics-2023-report-asia-ahead-of-europe-and-the-americas

https://reshorenow.org/content/pdf/1H2023_RI_Report.pdf

https://www.businessinsider.com/us-building-factories-census-data-chips-act-inflation-reduction-act-2023-6

https://reshorenow.org/content/pdf/1H2023_RI_Report.pdf

https://stoneridgetechnology.com/company/blog/the-exponential-growth-of-hardware-and-the-linear-growth-of-software/

https://www.accenture.com/us-en/insights/5g-index

https://www.ey.com/en_tw/innovation/three-tailwinds-for-robotics-adoption-in-2024-and-beyond

https://ark-invest.com/articles/analyst-research/industrial-robot-cost-declines/

https://www.therobotreport.com/industrial-robot-market-to-grow-5-7-out-to-2027/

Subscribe to Abe Murray | AlleyCorp / Deep Tech

AlleyCorp is investing in deep tech with a focus on advanced manufacturing, aerospace, and robotics 🤖 🦾 teams solving the world’s problems. We are based in Boston and NYC.